-

What are the investment objectives of COLOTRUST EDGE?

-

The general objective of COLOTRUST EDGE is to generate a higher level of income than provided by a traditional stable NAV LGIP while seeking to protect Participant capital. This is achieved by investing in only the highest quality securities that are legal pursuant to the Legal Investments Act (Part 6, Article 75, Title 24, C.R.S.) and the Public Deposit Protection Act (Articles 10.5 and 47 of Title 11, C.R.S.).

-

What types of securities are purchased for COLOTRUST EDGE?

-

All investments made on behalf of COLOTRUST EDGE are in compliance with the Legal Investments Act (Part 6, Article 75, Title 24, C.R.S.). For a complete list of eligible investments for COLOTRUST EDGE, please contact the COLOTRUST Relationship Team.

-

Is COLOTRUST EDGE rated?

-

Yes, the COLOTRUST EDGE portfolio is rated ‘AAAf/S1’ by FitchRatings.

The ‘AAAf’ rating is Fitch’s opinion on the overall credit profile within a fixed-income fund/portfolio and indicates the highest underlying credit quality of the pool’s investments. The ‘S1’ volatility rating is Fitch’s opinion on the relative sensitivity of a portfolio’s total return and/or net asset value to assumed changes in credit spreads and interest rates. The ‘S1’ volatility rating indicates that the fund possesses a low sensitivity to market risks. For a full description of rating methodology, please visit www.fitchratings.com. Ratings are subject to change and do not remove credit risk.

-

Does COLOTRUST EDGE seek to maintain a stable $1.00 net asset value (NAV)?

-

EDGE is a variable NAV fund managed to approximate a $10.00 transactional share price, calculating and publishing a fair value NAV on a daily basis. The COLOTRUST EDGE portfolio has designated a $10.00 transactional share price in order to clearly differentiate the portfolio from a traditional $1.00 stable NAV fund.

-

Does Board oversight differ between COLOTRUST PRIME, COLOTRUST PLUS+, and COLOTRUST EDGE?

-

No, the COLOTRUST Board of Trustees administers and oversees all investment portfolios offered by COLOTRUST now and in the future.

-

I need to add information regarding COLOTRUST EDGE to my CAFR notes in our financial statements; can you provide suggested language to include?

-

Yes; below please find our recommended language that you can customize to meet your specific reporting requirements and period. You can find the EDGE WAM and WAL for your specific reporting date on the Yields page.

“COLOTRUST EDGE is a variable net asset value (NAV) local government investment pool that offers weekly liquidity to Participants. EDGE is suitable for a local government’s strategic reserves/non-operating funds and has a NAV that is managed to approximate a $10.00 transactional share price. COLOTRUST EDGE measures its investments at fair value so investments in EDGE are not required to be categorized within the fair value hierarchy. EDGE is rated ‘AAAf/S1’ by FitchRatings. As of DATE, COLOTRUST EDGE possessed a weighted average maturity of XXX days and a weighted average life of XXX days.”

If you need additional assistance or have further questions about this language, please contact the COLOTRUST Client Service team.

-

How can I become a COLOTRUST EDGE Participant?

-

Current COLOTRUST Participants simply need to complete the EDGE Registration Form to begin investing.

New local governments looking to invest in any of the COLOTRUST portfolios will first need to pass a resolution authorizing participation in COLOTRUST; a model resolution is provided for your convenience in the COLOTRUST Registration Packet.

For more information, please contact the COLOTRUST Relationship Team to get started.

-

Is there a minimum dollar amount required for a COLOTRUST EDGE investment?

-

No, there is no minimum initial investment or ongoing minimum account balance is required to participate.

-

Will I see my COLOTRUST EDGE account when I log in to the online portal?

-

Yes, you will see your COLOTRUST EDGE account alongside your COLOTRUST PRIME and PLUS+ accounts (as applicable). You may also view any reports, such as monthly statements, that are associated with your COLOTRUST EDGE account in the Documents section under the Accounts tab.

-

How do I make a transaction?

-

To invest in COLOTRUST EDGE, COLOTRUST Participants must enter contributions through the Online Participant Portal. Withdrawn funds are available the business day after the transaction date that is entered in the online portal.

-

Is there a maximum number of transactions?

-

No, there is no limit to the number of transactions a Participant may execute with COLOTRUST EDGE.

-

Which of my funds are best suited for investment with COLOTRUST EDGE?

-

COLOTRUST EDGE offers next-day liquidity and is best suited for funds not needed on a frequent or near-term basis. COLOTRUST EDGE is designed to complement the daily liquidity offered by the PRIME and PLUS+ portfolios.

-

What risks are associated with investing in a longer-duration product?

-

For an explanation of the risks associated with investing in a longer-duration product, please read the COLOTRUST EDGE Information Statement.

-

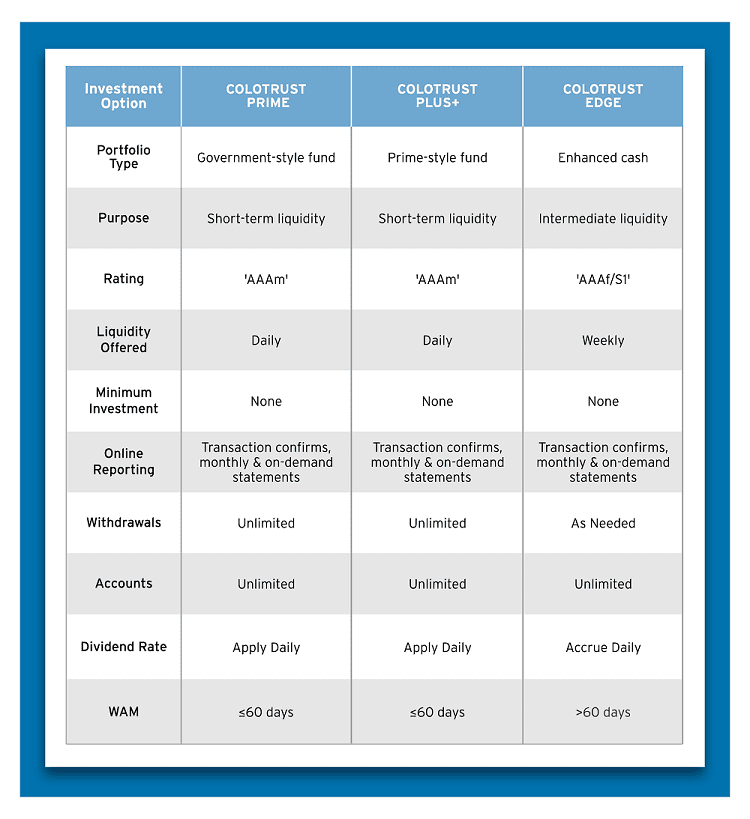

How do COLOTRUST PLUS+, PRIME, and EDGE differ?

-

COLOTRUST provides a suite of investment options tailored to assist your local government’s cash management needs. Please refer to the table below for a comprehensive view of each of the COLOTRUST portfolios.