Inflation Hits Another Minor Bump on Its Ride Down

October 2024 Economic Review U.S. inflation, as measured by the Consumer Price Index (CPI), showed mixed results in its most recent September reading. Both core inflation (which excludes volatile food

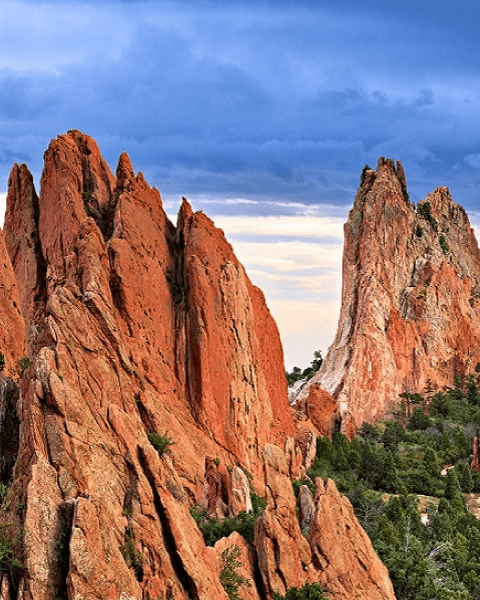

COLOTRUST PLUS+

COLOTRUST PLUS+ COLOTRUST EDGE

COLOTRUST EDGE